Great businesses think differently

Beavis Morgan is the specialist accounting, tax, restructuring and business advisory group.

We work with entrepreneurs, owner-managed businesses, high net worth individuals and other professionals through each stage of the business lifecycle and its challenges.

Whether you are starting up, buying, growing or exiting a business, we make it our goal to help you build and preserve wealth and enhance the value of your business.

Click here to find out more

Submit your contact details and we’ll be in touch shortly.

Our services

Services tailored to you and your businessOur latest news

The Spring Budget 2024, announced by Chancellor Jeremy Hunt on 6 March, strategically aligns with

The Spring Budget 2024, as presented by Chancellor Jeremy Hunt, has rolled out several significant

The Spring Budget introduced several measures impacting the hospitality sector, designed to create a more

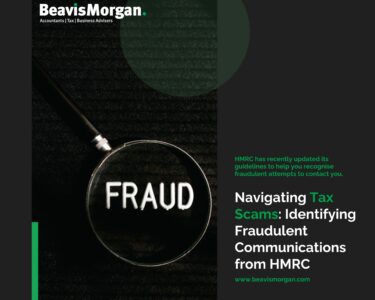

HM Revenue and Customs (HMRC) has recently updated its guidelines to help you recognise fraudulent